How To Get A Commercial Loan For Real Estate

Ownership or investing in commercial real manor can be both a thrilling and sometimes stressful endeavour. Without a commercial mortgage loan, though, about business organisation owners don't stand a chance of purchasing a commercial property.

Thankfully, commercial real manor loans are bachelor that tin make these dreams a reality — even if you lot don't have cash or other assets to secure the loan.

Many commercial real estate financing options are offered at affordable rates and agreeable terms. Below, nosotros'll break downwardly the various types of commercial property loans, how you can employ for them and how yous can get canonical without any hassles or headaches.

What Are Commercial Real Estate Loans?

Commercial existent estate (CRE) loans help business owners invest in income-producing properties for business organisation purposes.

Every bit with a residential real manor loan, a commercial property loan is a type of mortgage that is secured past a lien on the commercial property.

Investing in commercial real estate tin be a costly affair considering many office buildings and retail outlets are sold at a higher toll than their residential counterparts. Yet, a commercial property can provide a steady passive income through numerous cash inflows, including:

- Tenant rent

- Tax benefits

- Depreciation

- Gain from auction

- Operating expense recovery

- Parking, vending and service fees

How Do Commercial Real Estate Loans Work?

Commercial real estate loans are put toward the purchase of existing or new properties. They can too be used to purchase land or develop, construct or renovate a property. Additionally, you can refinance a loan on an existing commercial holding.

Examples of eligible property types include:

- Role space

- Building

- Business complex

- Shopping center

- Retail shop

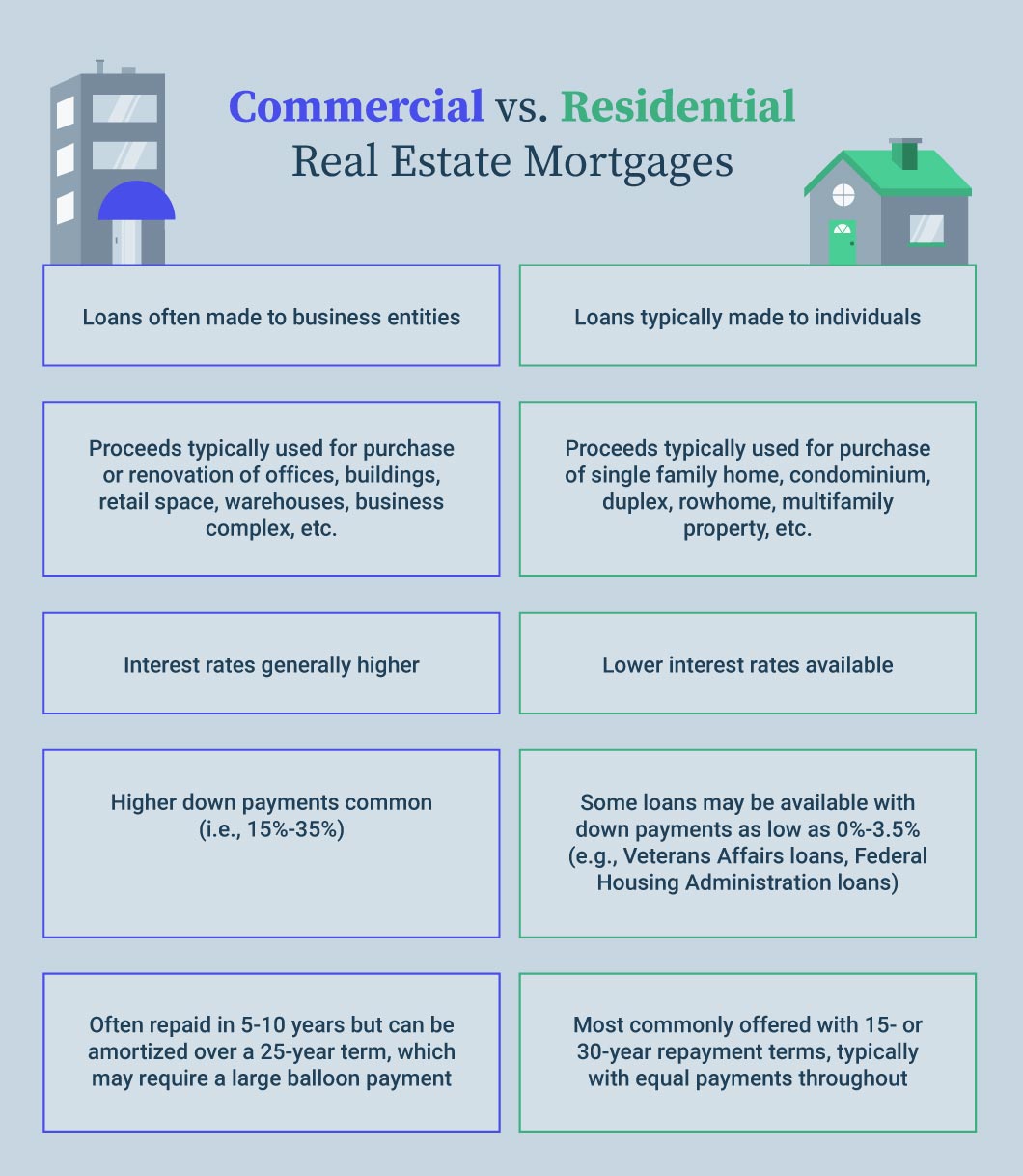

Commercial real estate mortgages are often made to business organisation entities, such as corporations, developers, trusts, funds or express partnerships, often formed for the specific purpose of investing in commercial real manor.

When it comes to real estate, some lenders accept commercial loan requirements that call for the borrower to occupy the space, so be sure to read the fine print.

As many concern owners know all too well, investing in commercial real estate tin can testify costly. Thankfully, a loan to buy commercial property can assist you lot pay for these costs. Generally, with these loan types, lenders put a lien on your purchased holding. If you default on the loan or cannot make payments, the lender can seize the property to recoup its losses.

Since commercial real manor loans tend to range in the 6, seven and 8 figures, they're inherently risky for creditors. If you don't brand proficient on your pledge to repay the loan, then the lender is out a substantial sum of coin.

To mitigate the risk of big-coin lending, commercial real estate loan lenders will require a downwards payment. Conventional lending institutions frequently require a down payment between fifteen%-35%, depending on the specific lender. In some cases, sure loans backed by the U.Southward. Small Business organisation Administration (SBA) may exist available with down payments as low as x%.

Navigating Commercial Real Estate Loan Terms

Ane of the least-understood aspects of commercial borrowing are commercial mortgage loan terms. Far too ofttimes business owners inexperienced in the world of commercial real manor lending are eager to jump on any offer extended to them.

However, it'south important to pay attention to repayment terms to understand the constructive toll of the loan.

Commercial real estate loans are ofttimes offered with repayment terms ranging between 5-ten years (or less), though some loans are also available extending upwards to 25 years in sure cases, such as with SBA loans. Keep in mind, shorter term loans are typically hard money loans with much higher involvement rates.

Be certain you conspicuously understand the terms and overall cost of the loan, including rates and fees, then yous get the best financing for your business concern.

Related: Amortization Schedule

How to Get a Commercial Loan for Real Manor

When you lot're in the market to buy a commercial property, your loan application should follow certain steps, which we'll outline below. These will include tips for how to become a commercial loan blessing, such as for SBA CDC 504 loan and SBA seven(a) commercial real estate loans.

Know Your Credit Score

Before you lot sign on the dotted line of a small-scale business real estate loan, there are several key pieces of data you lot need to consider. First amidst them is your concern credit score.

These scores are issued past credit reporting agencies, such as Dun & Bradstreet, Equifax and TransUnion, and provide a summary of your trustworthiness to lenders. Although personal credit scores range from 300 to 850, concern credit scores ofttimes range from 0 to100.

Oft, lenders offering loans to purchase commercial holding require a minimum credit score in the range of 660-680.

Notwithstanding, if you desire to qualify for the best commercial real estate loans, then you should autumn safely within the highest business concern credit score bracket. The ameliorate your score, the more than likely yous'll get approved for the well-nigh competitive interest rates and terms.

Prepare Your Documentation

In improver to reviewing your credit score, many commercial existent estate lenders will desire to await at other business concern details. Get ready to employ by gathering the post-obit commercial loan requirements:

- Business programme

- Business organization tax returns

- Financial reports

- Collateral details

- Property appraisement

- Most recent 3 months of bank statements

Better Your Chances

When you're looking for a loan to purchase commercial property, you'll desire to make sure you lot accept the best credit score possible. Yous can do this by making debt payments on time and pay down existing debt.

Here are a few other means you can brand yourself more appealing to lenders:

- Provide collateral

- Get a cosigner

- Offer a larger downwards payment

- Don't select a holding that'due south too expensive

Run into a Lender's Commercial Real Estate Loan Requirements

Your business organisation credit score isn't the but factor determining your eligibility for a CRE loan. Other commercial property loan requirements that lenders review include the following:

- Overall fourth dimension in business

- Value of collateral assets

- Debt service coverage ratio

- Annual revenues

- Cash menstruum

For a well-rounded application, you'll desire to ensure that yous business relationship for each of these elements.

Aim to be in business for at least 2 full calendar years before you utilise for a major loan. Additionally, your gross income should exceed your total debts. This manner, creditors volition have confidence in your ability to repay the loan.

Related: How to Get the All-time Commercial Real Manor Loan Rates

Types of Commercial Existent Manor Loans

In that location are several types of commercial existent manor loans, each having its benefits and drawbacks. No matter the blazon of business you own, if you're in the market for a business real estate loan, yous might consider applying for 1 of the following :

- SBA commercial existent estate loans, including 7(a) and Certified Development Company (CDC) 504 loans

- Conventional commercial mortgage

- Commercial bridge loan

- Hard money loan

Additionally, another selection when you're thinking about how to go a commercial loan is to consider alternative financing from online lenders. They are able to offer fast, less stringent funding options for whatever business need.

SBA Commercial Real Estate Loans

One of the best commercial existent estate loans is a standard SBA 7(a) loan or a CDC/SBA 504 loan, both of which are partially secured by the Small-scale Business concern Assistants (SBA).

In terms of SBA commercial real estate loan requirements, the 7(a) loan is meant to exist a full general-purpose loan for modest businesses, proceeds from which can be put toward any business-related expense. In dissimilarity, funds from the 504 loan must be spent on capital letter-intensive property (usually existent estate or renovations).

These SBA loan options are meant for long-term borrowers. Term lengths range from five-25 years, and interest rates for SBA loans cannot exceed a maximum percentage. For instance, standard 7(a) loans have a maximum interest rate ranging from the prime number rate plus 2.25% to the prime rate plus four.75%, depending on the loan term and corporeality.

Conventional Commercial Mortgage Loan

Unlike SBA-backed commercial property loans, conventional commercial mortgages are a type of commercial land loan issued exclusively by banks. These loans tend to be more than difficult to qualify for and, generally, take strict commercial real estate loan requirements concerning years in business organization and annual revenues. For this reason, they often aren't the outset choice among new business organisation owners.

-

Examples of Conventional Commercial Mortgages

While interest rates and repayment terms vary depending on diverse factors, including lender and loan type, hither are some commercial real estate loans offered through conventional banks.

With Depository financial institution of America, commercial real estate loans for purchasing or refinancing start at $25,000, with involvement rates every bit low every bit 5.25% with a fee of 0.75%, as of July 27, 2022. Loan terms are available for upward to 10 years with a balloon payment at the end of the term. Or if y'all want to exist done paying the loan by the end of the term, the depository financial institution offers a fully amortized loan to exist repaid in xv years, eliminating a balloon payment.

In contrast, Chase offers owner-occupied commercial real estate mortgages starting at $l,000 with repayment terms up to 25 years, with financing available for up to 90% of the belongings value.

Bridge Loans for Commercial Real Estate

If yous only need a brusk-term financing solution, consider applying for a commercial bridge loan. This type of loan chop-chop reaches maturity, at which point the loan must be repaid in full or extended into the long term.

Hard Coin Commercial Existent Estate Loans

Difficult money commercial real estate loans are another form of short-term financing. They're offered at higher involvement rates and are targeted toward young businesses that cannot qualify for conventional commercial holding loans.

Should You Apply for a Commercial Real Estate Loan?

At present that you lot know how to become a commercial loan for existent manor, how should y'all keep?

If you make up one's mind to apply, research your lending options to ensure you meet the commercial existent estate loan qualification requirements for blessing. For instance, consider that many lenders accept a commercial real estate loan downwards payment requirement.

Besides, make sure the repayment term doesn't lock you into a never-ending debt screw and that the involvement rate won't upset your debt-to-income ratio. For the best results, inquiry lenders and their financing options to run into which offer the all-time terms for your real estate commercial loan needs.

How To Get A Commercial Loan For Real Estate,

Source: https://www.fastcapital360.com/blog/commercial-real-estate-loans/

Posted by: waxwitte1979.blogspot.com

0 Response to "How To Get A Commercial Loan For Real Estate"

Post a Comment